How to Transfer Proprietorship Firm in GST?

- 14 Jul 25

- 8 mins

How to Transfer Proprietorship Firm in GST?

- New GST Registration Prerequisites

- How to Obtain GST Registration for Partnership?

- Proprietorship & Partnership: Filing of Returns Procedure

- Business Transfer to Partnership Firm

- Unutilised Input Tax Credit to Partnership Firm Transfer

- Balance Transfer to the Partnership’s Electronic Cash Ledger

- GST Registration of Proprietorship Cancellation

- Conclusion

Key Takeaways

- No direct GST provision exists for conversion, but procedural steps ensure legal compliance.

- Partnership firms must obtain PAN and GST registration before transfer.

- GST return filing dates must align for both proprietorship and partnership.

- Unutilised ITC can be transferred via Form ITC-02 with a CA certificate.

- Electronic cash ledger balance must be refunded—not transferred—to the new firm.

To seamlessly transfer the ownership of a proprietorship firm under GST demands compliance and precision. However, there is no provision in particular, provided under the Goods and Services Tax (GST) Act, stating how a proprietorship shall be converted into a partnership.

Yet still, there are notable mentions of the conversion of a proprietorship into a partnership firm in the act. This involves unutilised Input Tax Credit (ITC) transfer to partnership firms, obtaining GST registration for the partnership, and cancelling GST registration of the proprietorship.

This blog shall break down the step-by-step process of how to transfer proprietorship firms in GST while avoiding GST penalties and ensuring a smooth transition altogether.

New GST Registration Prerequisites

The first step to converting the proprietorship entity involves the establishment of a partnership firm. Next, the partnership firm's PAN, bank accounts and GST registration will be obtained. To initiate the process, partners will be required to write down an agreement, referred to as a “Partnership Deed”.

The deed will specify all the relevant terms and conditions under which the partnership shall come into force.

As soon as the partnership deed is ready, a registered taxpayer must:

● Apply for a PAN number with the income tax department; this is a mandatory prerequisite for successful GST registration.

How to Obtain GST Registration for Partnership?

After the respective partnership firm’s PAN is obtained, one can apply for GST registration via the REG-01 form.

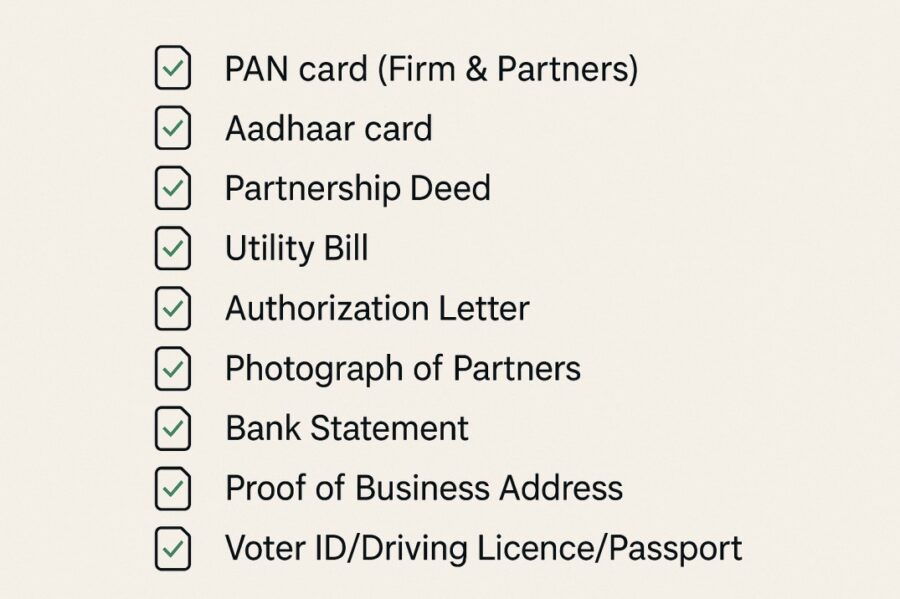

Here is a list of documents required to apply under GST:

● Partnership deed

● Photographs of all the partners

● PAN card of the firm in question

● PAN card of all the partners

● Aadhaar Card/ voter ID/ driving licence/ passport of all partners with the right address (provided in the partnership deed)

● A document as proof of the company's business place/place address

● Property tax receipt/ utility bill (most recent of at least two months) of the concerned business premises

● An authorisation letter to authorise a partner as an 'approved signatory' for the process of GST registration (on behalf of the partnership firm)

● Certificate of registration copy under any other act

● Bank account passbook or statement

Once all of the above-mentioned documents are obtained, the taxpayer can apply for GST registration for their established partnership firm.

Proprietorship & Partnership: Filing of Returns Procedure

Here are the requirements for the filing of returns by proprietorship and partnership:

● When the taxpayer submits the cancellation for GST registration of a proprietorship firm, they are required to provide the date on which the details to GST registration is supposed to be nullified.

● When the taxpayer applies for the fresh registration of the partnership, they are obliged to provide the date on which registration liabilities emerge.

● Thus, the taxpayer must ensure that both the mentioned dates remain the same, as it shall become the effective date for the registration of a partnership under GST.

The proprietorship firm must file all the GST returns up until the latest GST registration date is established. Further, the partnership firm must start to file the GST returns starting from the date of the new GST registration.

Business Transfer to Partnership Firm

Transfer of stock or transfer of assets during the conversion of a pre-existing proprietor to a partnership firm is exempted under GST. This is because the goods and assets are transferred with the view to continuing with the same type of business. The exemption is particularly mentioned in the CGST Act's Schedule II.

This exemption benefit is available only when the already existing firm stops being a ‘taxable person/entity’ post-conversion. According to the CGST rate notification (1/2017), the transfer of a going concern is also exempted, establishing clarity regarding the going concern not being taxable under the GST system.

Unutilised Input Tax Credit to Partnership Firm Transfer

Once the filing process for the pending returns is completed, the taxpayer shall proceed to transfer the unutilised ITC to the new partnership entity.

Here are the steps involved in the transfer of unutilised ITC to the new partnership:

● The proprietorship business must file the Form GST ITC-02 in order to initiate the transfer of the unutilised ITC to the partnership firm’s electronic credit ledger.

● The proprietorship firm must file a copy of the certificate, as issued by a practising Cost Accountant/ Chartered Accountant. This document shall certify that the business is transferred with a particular provision (aimed at the transfer of liabilities).

● The new partnership must accept the details as provided by the proprietorship firm via the GST portal. Post-approval, the unutilised ITC mentioned in the GST ITC-02 Form will be credited to the partnership's electronic credit ledger.

● The partnership firm’s books of accounts shall account for the inputs/capital goods thus transferred.

Balance Transfer to the Partnership’s Electronic Cash Ledger

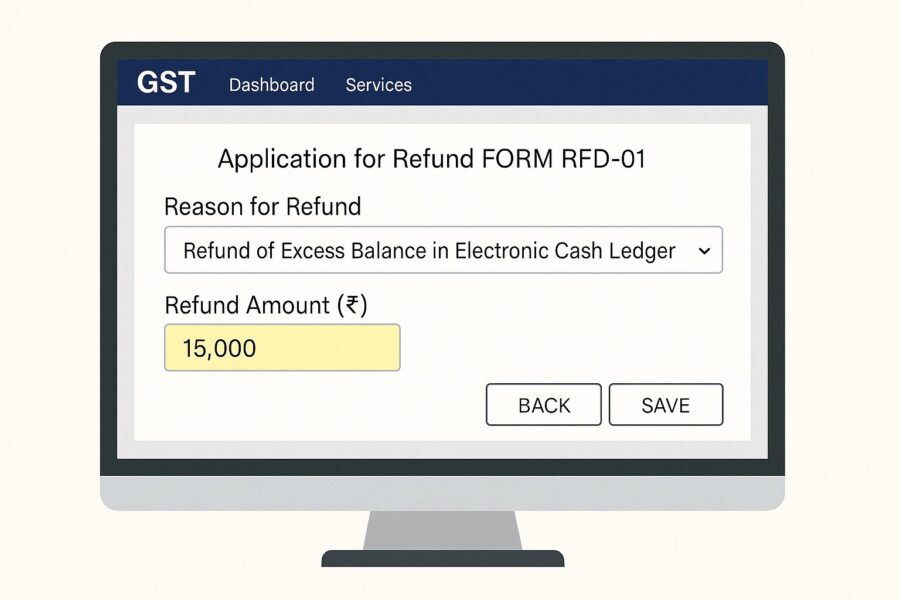

No provision is made under the GST Act that specifies the transfer of balance process in the electronic cash ledger from one firm to another.

Therefore, the registered taxpayer is entitled to file the RFD-01 legal Form against a refund type of “Refund on Account of Any Other Reasons”/ “Refund of Excess Balance in Electronic Cash Ledger” in order to obtain the balance refund in the partnership electronic cash ledger.

GST Registration of Proprietorship Cancellation

After the pending returns are filed and the income tax dues are cleared, a request for GST registration certificate cancellation can be initiated via Form GST REG 16. Reasons such as ‘changing the company’s legal framework’ can be cited. The taxpayer will also be prompted to provide the new partnership entity’s GST number.

Conclusion

The entire process of the conversion of a proprietorship firm to a partnership firm has been discussed in detail above. The same process of conversion shall apply in other cases as well, given that one legal entity converts into another. This includes the conversion of a partnership entity into a proprietorship, a public limited/OPC/private limited, etc.

By following the above-mentioned steps on how to transfer a proprietorship firm in GST, ensure GST compliance and successfully transfer your proprietorship firm. Thus, maintain business continuity while avoiding any GST penalties.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

Can a proprietorship firm be converted into a partnership under GST?

Is it possible to transfer the unutilised Input Tax Credit (ITC) from the proprietorship to the new partnership?

What happens to the balance in the electronic cash ledger of the proprietorship?

When should the GST registrations for both entities be updated or cancelled?

What documents are required for obtaining GST registration for the partnership firm?

PAN card of the firm and all partners

Aadhaar/voter ID/passport/driver’s license of partners

Partnership deed

Business address proof (e.g., utility bill, property receipt)

Bank statement

Authorisation letter for an authorised signatory

These documents must be submitted through Form REG-01 on the GST portal.